Contents:

In the bearish cypher points A and C must make successively lower lows and point D should be below X. The cypher is a five point harmonic chart pattern, made up of points XABCD. The cypher is easy to spot on a chart because it has a characteristic wave like appearance displaying either rising peaks or falling valleys. This article is for information purposes only and should not be considered trading or investment advice.

More, you can use the cypher harmonic pattern on its own and have a profitable Forex trading strategy. It’s no mystery that geometric patterns can be found in the Forex price chart and the cypher pattern is a very good representation of that. The Cypher pattern forex is part of the Harmonic trading patterns and is the most exciting harmonic pattern as it has the highest winning rate.

Upon the cypher patterns reaching the 78.6% retracement level at point D, the bearish Cypher pattern is considered complete, and a price decline is expected. The CD leg moves higher and terminates near the 78.6% retracement level of the price move from point X to point C. Upon the price reaching the 78.6% retracement level at point D, the bullish Cypher pattern is considered complete, and a price rise is expected. The CD leg moves lower and terminates near the 78.6% retracement level of the price move from point X to point C. Notice above, we can see that the pattern is a five-point structure, denoted as XABCD. As such, there are a total of four individual legs that make up the pattern.

But, from the conventional labeling perspective, and the Fibonacci ratio requirements, they are quite a bit different. Lt’s now discuss some of the more intricate rules for correctly classifying a valid cypher pattern. The initial leg of the pattern is called the XA leg, and is impulsive in nature.

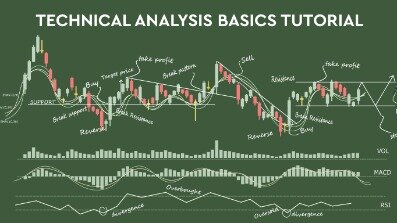

Are Candlestick Patterns Reliable

The cypher patterns’ principal issue is that, for the bullish cypher, the crest and the trough are trending upwards. Chart Pattern recognition is the basic and primary ability any trader develops in Technical Analysis. It may be basic development, but the perfection of pattern recognition takes extensive practice and repetitive exposure. The expert recognition of patterns helps traders to quantify and react to the changing market environment. Chart patterns are categorized into “continuous” and “reversal” patterns, which are further classified as simple and complex patterns.

How To Identify A Trend Reversal In Forex Trading – Finance Monthly

How To Identify A Trend Reversal In Forex Trading.

Posted: Fri, 27 May 2022 07:00:00 GMT [source]

All you need to do is to place the stop loss somewhere below the D level because if this level breaks, the entire Cypher pattern is invalidated. So, the stop would be placed at the next support or resistance level, which is the X-point . Partnerships Help your customers succeed in the markets with a HowToTrade partnership.

Rules and targets for Cypher Pattern

The PRZ of D is a wide range where the price has to get to. C is an extension leg and goes beyond A – but must move to at least 127.2 percent, but it is normal for it to go as far as the 113 to 141.4 percent. It is considered invalid if it moves beyond the 141.4 percent. B has to retrace to an expansive range between 38.2 and 61.8 percent of XA, at least 38.2 percent, but not exceeding 61.8 percent.

- We can note the price only had a small deviation below the 0.786 Fibonacci ratio – our entry point.

- Trading coaches Meet the market trading coach team that will be providing you with the best trading knowledge.

- The bearish is just the opposite of the bearish, with an upside shape that looks like the letter W.

- Every swing leg must be validated and abide by the cypher pattern forex Fibonacci ratios shown above.

- For example, in Gartley bullish pattern, the target zones are computed using the XA leg from the trade action point .

The stop would go beyond the next structure support / resistance beyond the X-point. Conservative traders may look for additional confirmation before entering a trade, for instance an aligning RSI value or a specific candlestick pointing at a reversal. TradingView has a smart Cypher Pattern drawing tool, created especially for this popular pattern. Please note that the ratio line between the A and C points represents how far C extended the XA leg. The ration line between the X and D points represents how far D retraced the XC leg. This pattern gives a high risk-reward ratio and winning ratio because of its structure.

Before implementing, traders need to understand the variations of the Cypher pattern; bullish and bearish. It’s very improbable that the price will extend in a straight line from D. What happens more often is that one or two false breakouts happen, sometimes in both directions. Using a scaled entry is less risky because the exposure only increases if the trend shows more strength on the bullish side.

It may help for https://trading-market.org/rs to use an automated pattern recognition software to identify these patterns, rather than using the naked eye to find or force the patterns. It’s easy to get confused between the Cypher and butterfly patterns. Both harmonic patterns have a similar formation, and they appear in the same place and signal that the price is about to reverse.

Let’s check some of the pros and cons of the cypher pattern. EFC is the favorite when it comes to reversal indicators. This is only one of nearly 50 or more trades that the EFC will show you right now. This strategy is a little advanced so when you read it please take special note of all the important steps.

Bearish and Bullish Cypher Patterns Rules

As we mentioned earlier, there’s no need to manually draw the Cypher pattern on Japanese candlestick charts. Instead, you can use a built-in indicator automatically highlighting Cypher harmonic patterns. It will help you better visualize the asset’s past performance. The Cypher patterns trading strategy is a reversal strategy. We want to make sure we capture as much as possible from the new trend. We need to establish the most logical place for our take profit level in the Cypher patterns trading strategy.

The first is the Fibonacci retracement tool, and the second is the Fibonacci projection tool. Both of which are available within most charting platforms. Additionally, there are harmonic patterns indicators and software programs that can automatically recognize and label the cypher harmonic pattern on the price chart.

Bullish Cypher Pattern

We can note the price only had a small deviation below the 0.786 Fibonacci ratio – our entry point. So, if you mainly trade in the lower time frame, don’t miss the chance to read the Best Stochastic Trading Strategy- Easy 6-Step Strategy. Lately, this article has received a lot of attention from our readers. This retracement should bring prices between the 38.2 to 61.8 level of the XA segment. Traders use two primary Fibonacci tools to define the Cypher pattern.

In structure, the Cypher pattern is similar to the butterfly harmonic pattern; however, the Cypher is not a very common chart pattern due to its unique Fibonacci ratios. Now, we’re going to review the Cypher pattern trading strategy rules. A harmonic cypher pattern is a five-wave pattern in which the Fibonacci ratio is followed. As Fibonacci is also a natural phenomenon so it makes some sense. Fibonacci is used to increasing probability to filter out weak patterns. A and C must make a low point with D lying below point X for a bearish cipher pattern.

Like other harmonic patterns, the Cypher requires that specific Fibonacci ratios be met before it is traded. However, the ratios used for the Cypher are relatively unique, which makes the formation one of the less common harmonic patterns. When properties appear in patterns, they add an additional constraint to the shape of the data. In the case of a CREATE clause, the properties will be set in the newly-created nodes and relationships. In the case of a MERGE clause, the properties will be used as additional constraints on the shape any existing data must have .

Cryptocurrency Technical Analysis And Charts: Rare Bullish Harmonic Pattern Ethereum’s Chart – Exchange Rates UK

Cryptocurrency Technical Analysis And Charts: Rare Bullish Harmonic Pattern Ethereum’s Chart.

Posted: Mon, 28 Oct 2019 07:00:00 GMT [source]

Notice how during the progress of this leg, the price breaks above the swing A high point. After the BC leg completes, prices began to move lower in the final leg of the move, known as the CD leg. The final leg within the cypher pattern will terminate near the 78.6% retracement of the prior move measured from point X to point C. The shark pattern on the other hand will terminate between the 88 and 113% of the price move as measured from point 0 to point B. The second swing high within the cypher pattern should terminate within the 127 to 141% level of the XA leg. For a shark pattern however, this termination range is quite a bit wider, specifically between the 113 and 161.8% level.

This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading. Identify the starting point X on the chart, which can be any swing high or low point. The image below represents the typical bullish Cypher pattern. If the shadow of the candlestick appears inordinately large, then it will be better to use the candle close for measuring.

- When using the Cypher Patterns, you should look out for the reversal motion of the CD leg.

- Once you’ve located your first swing high/low point, follow the market swing wave movements.

- This tool is very promising if we take into account the Risk-Reward ratio, and the 40% success rate.

- The first target, denoted on the price chart as target 1 would be set at the swing high of point A within the cypher pattern.

The cypher pattern trading strategy teaches traders how to trade and draw the cypher pattern perfectly. The pattern alone is enough to provide traders with a better trading strategy. The Cypher Pattern Trading Strategy will teach you how to correctly trade and draw the cypher pattern.

Cypher Pattern Indicator

First, we will give you indications on how to apply the Harmonic pattern indicator. The confluence of these levels in the Fibonacci Grid structure, along with emerging pattern structure (and pattern target/stop levels), helps a trader make a good decision. Pattern trading is very precise, as each pattern has specific rules to entry/stop and targets. When combined, harmonic pattern analysis and market context give a great edge to trade. Harmonic patterns can fail, but their failure levels are well-defined and that information is clearly known prior to the trade.

Cypher pattern is a geometric chart pattern in forex trading technical analysis. Trading geometric chart patterns are far better than lagging indicators. Geometric patterns make some sense because of natural phenomena as everything in this universe has a specific pattern.

Our team at Trading Strategy Guides is building a step-by-step guide on Harmonic trading patterns. We recommend reading the introduction to harmonic patterns. Read the article here, Harmonic Pattern Trading Strategy- Easy Step By Step Guide. TP will be achieved easily in a perfect cypher harmonic pattern. In the bearish cypher pattern, the XA wave will be a bearish impulsive move.

Fibonacci numbers are pervasive in the universe and were originally derived by Leonardo Fibonacci. The basic Fibonacci ratio or “Fib ratio” is the Golden Ratio (1.618). Fibonacci numbers are a sequence of numbers where each number is the sum of the previous two numbers.